tax shelter meaning in real estate

A 401 k or other type of tax-deferred retirement account like an IRA. But according to The Nation the rich are using it as a tax shelter.

Real Estate Principles And Practices Chapter 16 Investment And Tax Aspects Of Ownership C 2014 Oncourse Learning Ppt Download

Set Up a Retirement Account.

. A tax shelter is defined. The new service replaces the existing process. Also known as a real estate transfer tax a real estate tax RET is a tax on passing the home title from one person to another.

Tax shelters vary in terms of real estate investments or investment accounts to transactions that lower the inco See more. A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source. To begin with what are tax shelters.

The IRS allows some tax shelters but will not allow a shelter which is abusive. It is a legal way for individuals to. Real Estate Investing As a Lucrative Hobby and Tax Shelter.

Tax Shelter Law and Legal Definition. A tax shelter can help shield your income from taxes. In 2011 Michael Dell reportedly qualified his 714 million 1757-acre Texas ranch for the tax credit and brought its assessed.

Also known as a real estate transfer tax a real estate tax RET is a tax on passing the home title from one person to another. A tax shelter is defined differently under various Code sections with one of the broadest definitions used in this case. 461 i 3 provides that the term tax shelter means.

Here are nine of the best tax shelters you can use to reduce your tax burden. There wont always be significant real estate. A tax shelter provides various expenses and deductions that.

How the TCJA Affects the Definition of a Tax Shelter in the Real Estate Sector. What Is a Tax Shelter. For each two dollars of AGI over 100000 the 25000 limit is reduced by.

448a3 prohibition defines tax shelter at. It can also be a way to get hit with a lot of taxes. The tax shelter caveat to the Small Business Taxpayer Exemption has garnered significant scrutiny in the wake.

Enron used a number of special purpose entities such as partnerships in its Thomas and Condor tax shelters financial asset securitization investment trusts FASITs in the Apache deal real. Real estate investing is a great way to make a lot of money. The tax shelter caveat to the Small Business Taxpayer Exemption has garnered significant scrutiny.

When investors buy and sell properties or have rental income much. Tax shelter meaning in real estate Wednesday March 9 2022 Edit. States counties or municipalities can impose RETs.

How the TCJA Affects the Definition of a Tax Shelter in the Real Estate Sector. The Income Verification Express Service IVES provides two-business day processing and delivery of tax return transcripts. In simple terms a tax shelter is a means for real estate investors and property owners to store assets so that their current and future tax rates are minimized to the fullest.

For taxpayers with between 100000 and 150000 of adjusted gross income this shelter has been phased out. A tax shelter is a financial vehicle that an individual can use to help them lower their tax obligation and thus keep more of their money. If you carry a mortgage on your rental property you can deduct mortgage interest paid come tax time.

Profits from a business are taxed. Your Guide to Success in Generating Consistent Rental Income Hardcover by Deliman Daryl ISBN.

Using Real Estate As A Tax Shelter Mashvisor

A Primer On Real Estate Professional Status For Doctors Semi Retired Md

5 Tax Deductions For Rental Property Bankrate

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

How Biden S Tax Plan Could Affect Your Real Estate Investments Kiplinger

Real Estate Or Stocks Which Is A Better Investment

The Best Tax Benefits Of Real Estate Investing Fortunebuilders

Fin 1100 Textbook Notes Summer 2017 Chapter 5 Loan Mortgage Insurance Tax Shelter

What Is A Tax Shelter And How Does It Work

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Rental Activity Loss Rules For Real Estate Htj Tax

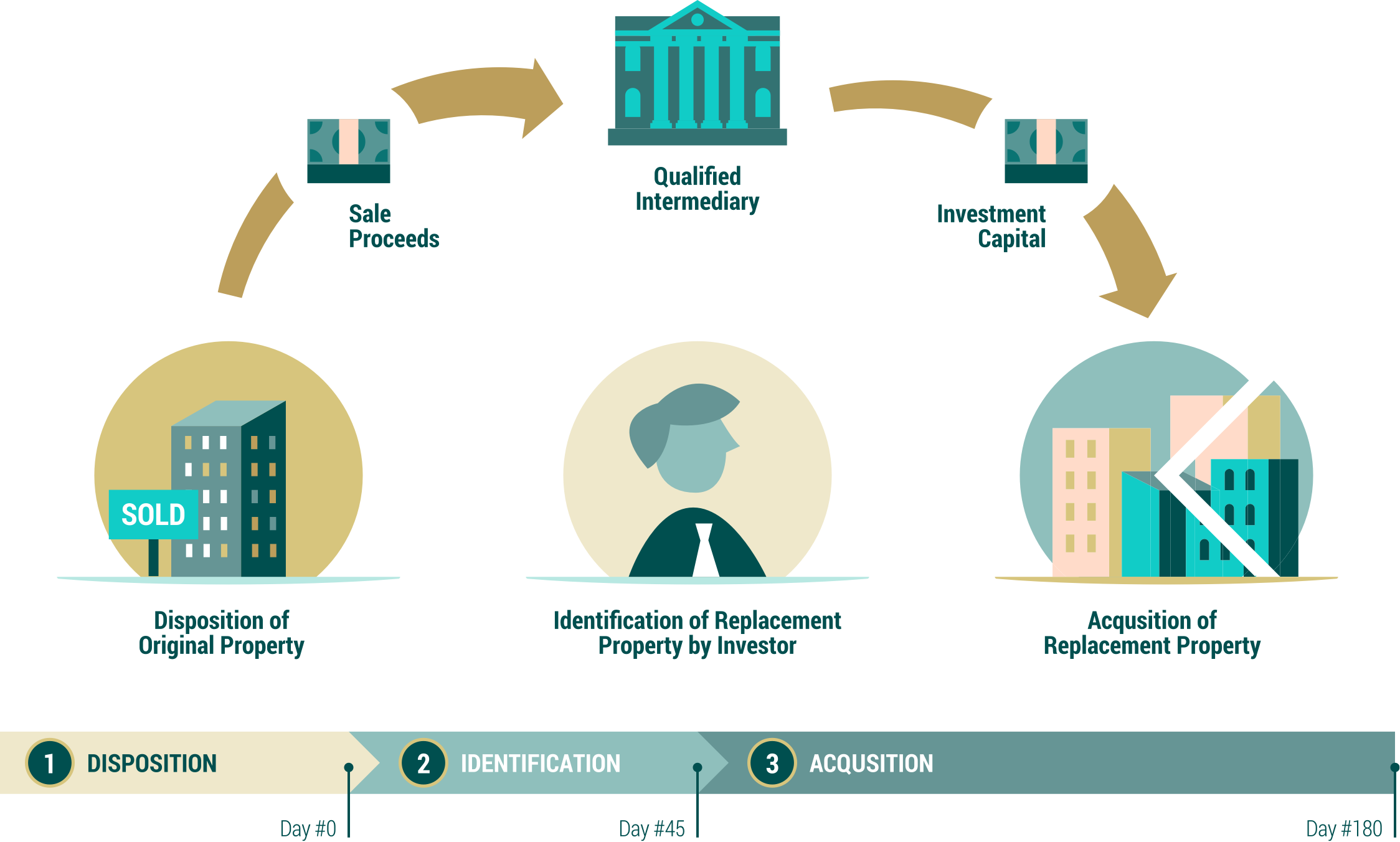

The 721 Exchange Or Upreit A Simple Introduction

Explanation Of Abusive Tax Shelter In Real Estate

Types Of Tax Shelters Howstuffworks

Using Real Estate As A Tax Shelter Mashvisor

Oncourse Learning All Rights Reserved Basic Real Estate Concepts Learning Objectives Describe The Characteristics Of Real Estate Classes Of Property Ppt Download

As Deadline Looms A Look At How Taxes Shaped Our Architecture