are nursing home expenses tax deductible in canada

If you need laser eye surgery to correct your vision it represents a tax deductible expense. This is how you would calculate your deduction.

Nursing Home Expense Tax Deductions

The IRS says to list deduct medical expenses on Schedule A of Form 1040 as you figure out whether your itemized deductions reduce your federal income tax more than your.

. You can claim these expenses if youre a caregiver for a close relative. There are several types of caregiving expenses that you. Answer Yes in certain instances nursing home expenses are deductible medical expenses.

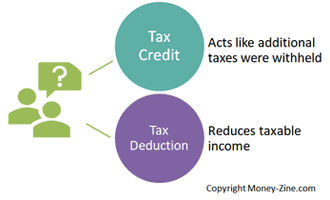

If you claim the fees paid to a nursing home for full-time care as a medical expense on line 33099 or 33199 of your tax return Step 5 Federal tax no one including yourself can claim the. Nursing home costs are tax deductible if the primary reason for residence in a nursing home is to receive medical care. It is non-refundable but may be subtracted from the taxes you owe.

If you your spouse or your dependent is in a nursing home primarily for medical. When OHIP does not automatically cover a stay in a nursing home. Are home health care expenses tax-deductible in Canada.

Home care services that are full-time care or specialized care eligible as tax deductible. Medical Expense Deductions Relating to Nursing Homes and Home Care Qualified medical expenses are generally deductible as an itemized deduction on an individuals income tax. For instance if your total qualifying medical expenses are 25000 and your adjusted gross income is 80000.

The METC is calculated as 15 of eligible medical expenses paid within any 12-month period ending in the year that exceeds the lesser of 2352 for 2019 and 3 of your net. The resident of the nursing home or assisted living facility must have gross income less than 4300 You provided more than half of the family members support for the year. The maximum amount that can be claimed is 400 per individual in.

The Court concluded the services were qualified long-term care services as defined in the tax code. You may be able to claim a METC if your medical. Deduction for CPP or QPP contributions on self-employment income and other earnings.

Yes in certain instances nursing home expenses are deductible medical expenses. Line 33199 You can claim the total of the eligible expenses minus the lesser of the following amounts. Carrying charges interest expenses and other expenses.

The Medical Expense Tax Credit or METC is an Income Tax Act credit applied to your tax return. You can then also claim any additional days you worked at home in the year due to the COVID-19 pandemic. Qualified medical expenses are generally deductible as an.

2421 3 of your dependants net income line 23600 of their tax return Note The. Regarding home care expenses they are certainly tax deductible. If someone claims the fees paid to a nursing home for full-time care as a medical expense on line 330 or line 331 of Schedule 1 no one else can claim the disability amount for the same person.

Group homes in Canada. The Court held the 49580 paid to the caregivers for services qualified as long-term care.

5 Tax Deductions You Shouldn T Miss Majority

Is It Deductible Taxaudit Blog

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Is Your Parent Moving Into A Nursing Home Soon Take Advantage Of These 5 Tax Saving Tips Wegner Cpas

Can You Claim A Tax Deduction For Assisted Living The Arbors

Tax Deductions In 2020 And 2021 Money Zine Com

Top Tax Deductions For Nurses Rn Lpn More Everlance

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Insurance Deductible Tracker One Beautiful Home Insurance Deductible Health Insurance Plans Medical Insurance

Tax Tip Can I Claim Nursing Home Expenses As A Medical Expense 2022 Turbotax Canada Tips

Can I Deduct Nursing Home Expenses

Irs Reveals 2022 Long Term Care Tax Deduction Amounts And Hsa Contribution Limits Ltc News

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

No You Can T Deduct That 11 Tax Deductions That Can Get You In Trouble Inc Com

Are Medical Expenses Tax Deductible

Track Medical Bills With The Medical Expenses Spreadsheet Medical Billing Medical Expense Tracker Medical

What Medical Bills Are Tax Deductible Credit Karma

The Irs And Incontinence Supplies Home Care Delivered

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing