us exit tax green card

The Exit Tax Planning rules in the United States are complex. The 8-out-of-15-year test is satisfied.

Exit Tax Us After Renouncing Citizenship Americans Overseas

5 Get Your Tax Ducks in a Row BEFORE Giving Up a Green Card.

. A green card holder must have been a lawful permanent resident in eight of the 15 years ending with the year of expatriationin other words the green card holder is a long-term resident a defined term in the IRC. Under such circumstances the. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US.

If Green Card status commenced in 2013 or earlier there is an exit charge in 2020 as. The IRS Green Card Exit Tax 8 Years rules involving US. Legal Permanent Residents is complex.

This is known as the green card test. Although the green-card holder would remain a US. Exit tax applies to United States expatriates a term describing people who have renounced their US citizenship and those who have renounced a Green Card that they have held for at least eight years out of the.

To trigger the exit tax the IRS must classify you as a covered expatriate. Transfers made while a non-resident non-citizen for estate and gift tax purposes are not subject to US. The exit tax process measures income tax not yet paid and delivers a final tax bill.

As a green card holder you do not need to count years if you make a valid treaty election to be treated as a nonresident alien for that entire calendar year. Renouncing citizenship or giving up a green card can be expensive when it comes to the IRS. Citizens who have renounced their citizenship and long-term residents as defined in IRC 877 e who have ended their US.

Income tax purposes domicile for estate and gift tax purposes may be moved outside the US. The US has enacted an Exit Tax that prevents US citizens and green card holders from giving up their residency in order to avoid paying US taxes on accumulated wealth. The exit tax is also imposed on green card holders who have held a green card for 8 out of the last 15 years referred to as long-term residents.

This can mean that green card holders who have not formerly surrendered the green card are stuck. It applies to individuals who meet certain thresholds for annual income net worth. The IRS requires covered expatriates to prepare an exit tax calculation and certify prior years foreign income and accounts compliance.

Citizens Green Card Holders may become subject to Exit tax when relinquishing their US. If I give up my citizenship or long-term green card I can avoid paying US taxes on my appreciated assets. Different rules apply according to.

In brief summary the HEART Act Exit Tax affects US citizens and permanent residents or Green Card holders who are planning to renounce their US citizenship or give back their Green Card. The us has enacted an exit tax that prevents us citizens and green card holders from giving up their residency in order to avoid paying us taxes on accumulated wealth. It is always worth checking whether you.

You are a long-term resident which means you have held a green card in at least 8 of the previous 15 years IRC 877 e 2 877A g 5. Federal tax purposes if you are a lawful permanent resident of the United States at any time during the calendar year. They remain subject to US Income Tax but cannot afford to surrender the card because of the exit tax they will have to pay.

Status they are subject to the expatriation and exit tax rules. 877 877A 8854. Green card holders are also affected by the exit tax rules.

The irs green card exit tax 8 years rules involving us. 2 IRC 877 Expatriation to Avoid Tax when Giving Up a Green Card. Green Card Exit Tax 8 Years Tax Implications at Surrender.

In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or green card. For some there is even an irs tax on your exit. Transfer taxes unless the property gifted is tangible and located in the US.

The 8 years are. The exit tax occurs from us. From an immigration perspective it is relatively straightforward the person usually files a Form I-407 by mail and waits for approval.

When a US person gives up their green card it can be a very complicated ordeal from an IRS tax perspective. If Green Card status commenced in 2014 or later the exit tax does not apply. Green Card Exit Tax 8 Years.

US Exit Tax Giving Up a Green Card. Resident status for federal tax purposes. You are a lawful permanent resident of the United States at any time if you have been given the privilege according to the immigration laws of residing permanently in the United.

For people who currently have green cards the only way to avoid the exit tax is to avoid the in 8 of the last 15 years rule that converts them from merely resident to long-term resident status and subject to the exit tax rules. For Green Card holders to be subject to the exit tax they must have been a lawful permanent. The general proposition is that when a US.

For example if you got a green card on 12312011 and plan to expatriate in 2018 you will be treated as a long-term resident under the expatriation tax law. Its critically important to understand that Green Card holders who are long term residents may be subject to the 877A expatriation tax if they surrender their Green Card. You cease to be a lawful permanent.

Your risk exists if. Green Card status is formally revoked in 2020. Gary Clueit in conversation with IRSMedic and Expatriationlaw makes it clear that the Sec.

Giving Up a Green Card. You are a resident for US. The exit may apply to us.

2801 tax on bequests from covered expatriates WILL affect his estate. Exit Tax is a tax paid on a percentage of the assets that someone who is renouncing their US citizenship holds at the time that they renounce them. Heres how the feds compute the Exit Tax.

3 IRC 877A Tax Responsibilities at Expatriation US Exit Tax 4 Form 8854 when Giving Up a Green Card. If you make the election to be a nonresident of the United States for income tax purposes you risk triggering the exit tax. Contents hide 1 Giving Up a Green Card.

Citizen renounces citizenship and relinquishes their US. Giving Up a Green Card US Exit Tax.

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Renouncing Us Citizenship Expat Tax Professionals

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Exit Tax Us After Renouncing Citizenship Americans Overseas

E Mail Us With Your Questions Outta Focus Lowrententertainment Com Subscribe Http Www Youtube Com User Lowren Usa Traffic Signs Highway Signs Exit Sign

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

![]()

Japan S Exit Tax Sme Japan Business In Japan

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Exit Tax In The Us Everything You Need To Know If You Re Moving

Renounce U S Here S How Irs Computes Exit Tax

Green Card Exit Tax Abandonment After 8 Years

9 States That Don T Have An Income Tax Income Tax Tax Income

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Exit Tax In The Us Everything You Need To Know If You Re Moving

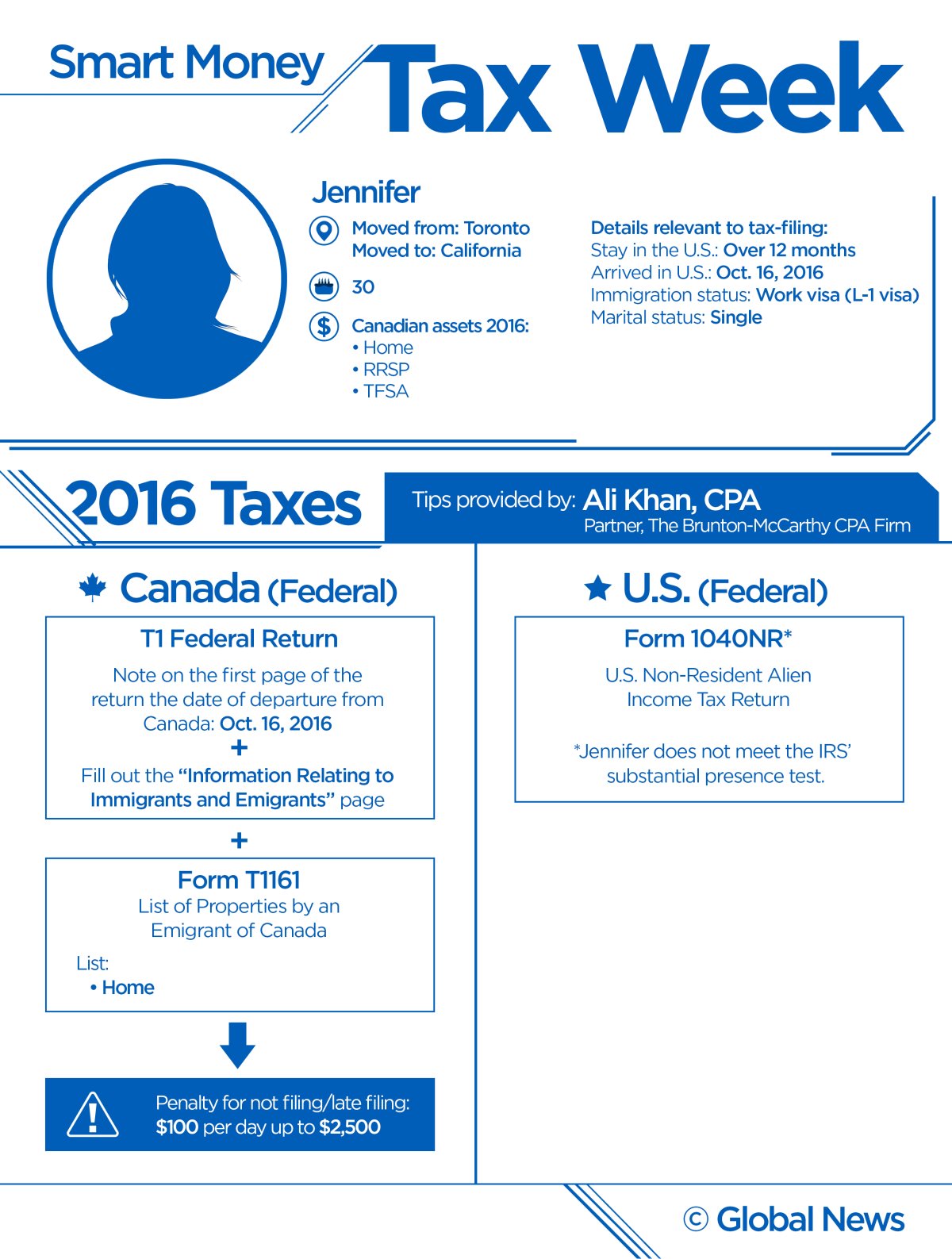

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca